If shareholders’ equity is negative, the most common issue is excessive debt or inconsistent profitability. However, there are exceptions to that rule for companies that are profitable and have been using cash flow to buy back their own shares. For many companies, this is an alternative to paying dividends, and it can eventually reduce equity (buybacks are subtracted from equity) enough to turn the calculation negative.

Examples of Return on Common Equity

For example, say that two competing stores both earn $100 million in income over a period. Emily Guy Birken is a former educator, lifelong money nerd, and a Plutus Award-winning freelance writer who specializes in the scientific research behind irrational money behaviors. Her background in education allows her to make complex financial topics relatable and easily understood by the layperson.

How To Calculate Return On Equity (ROE)

- Before embarking on calculating ROCE, familiarizing yourself with a few key concepts is crucial.

- Investors often compare a company’s ROCE against that of its peers to discern its relative performance.

- Industries with relatively few players and where only limited assets are needed to generate revenues may show a higher average ROE.

- Net income is calculated as the difference between net revenue and all expenses including interest and taxes.

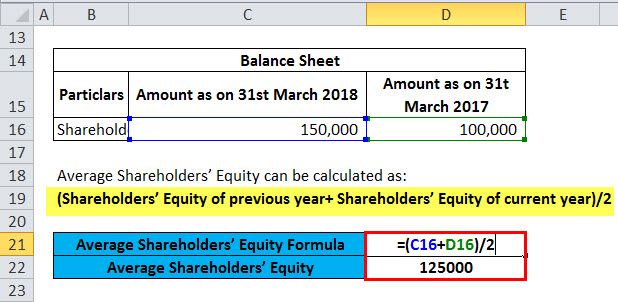

Since the equity figure can fluctuate during the accounting period in question, an average of shareholders’ equity is used. Return on equity measures how efficiently a firm can use the money from shareholders to generate profits and grow the company. Unlike other return on investment ratios, ROE is a profitability ratio from the investor’s point of view—not the company. In other words, this ratio calculates how much money is made based on the investors’ investment in the company, not the company’s investment in assets or something else.

Return on Equity Calculator (ROE) Excel Template

Return on Equity (ROE) is a revealing financial ratio that illustrates how effectively a company utilizes its equity base to generate profits. It is a key indicator of managerial efficiency and a company’s potential for long-term value creation for shareholders. In the realm of financial analysis, ROCE is more than just a percentage—it’s a window into the operational effectiveness of a business. It uniquely focuses on common shareholders, disregarding preferred shares and other forms of equity. Net income over the last full fiscal year, or trailing 12 months, is found on the income statement—a sum of financial activity over that period.

It’s essential to compare different companies’ financial ratios to gain a comprehensive understanding of their performance. By analyzing a company’s income statement and balance sheet, you can compute ROE by dividing the net income by the equity capital. ROE is a tool that allows you to measure a company’s profitability by examining the returns it generates on the money shareholders have invested. This ratio considers both the income statement and the balance sheet to determine how well a company is utilizing retained earnings to generate profits. Since most investors are common shareholders, it’s not uncommon to see this formula adjusted to account for any profit that’s earmarked for the payment of preferred share dividends.

Perhaps you already own shares in Company FF, and you’d like to measure its return on common stockholders’ equity for the past year. To calculate the ROE, the net income of a firm is divided by the invoice templates for word and excel common shareholders’ equity. This equity ratio analysis is a useful tool for both investors who already own shares in a company and those who are considering it as an investment opportunity.

Because net income is earned over a period of time and shareholders’ equity is a balance sheet account often reporting on a single specific period, an analyst should take an average equity balance. This is often done by taking the average between the beginning balance and ending balance of equity. Also, keep in mind that return on common equity doesn’t tell you anything about cash flows.

Understanding its risks and limitations is crucial for a clear and accurate assessment. A negative ROCE, where a company incurs a loss or has negative shareholder equity, signals operational challenges. Such a scenario necessitates a thorough review to identify and address the underlying issues impacting profitability. Though ROE can easily be computed by dividing net income by shareholders’ equity, a technique called DuPont decomposition can break down the ROE calculation into additional steps.

The difference between return on equity (ROE) and return on assets (ROA) is tied to the capital structure, i.e. the mixture of debt and equity financing used to fund operations. The optionality to raise capital is applicable to all companies and a trait that investors seek in potential investments (and the management team). It represents proof of a company’s ability to efficiently use capital and execute thoughtful strategic decisions. Return on Equity (ROE) is a widely used indicator of a company’s profitability but can sometimes provide a distorted view of financial performance.