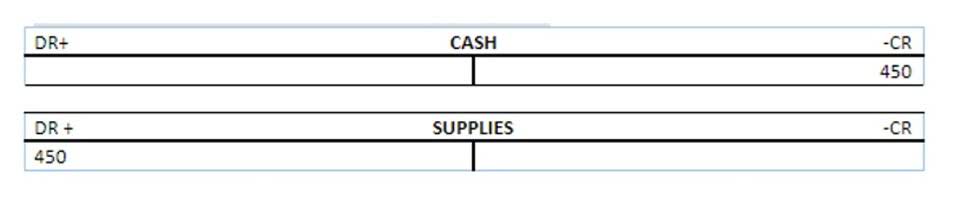

Ensure that your monthly account balances match, calculate revenue and expenses accurately, and cross-reference your receipts with bank statements. Consider adopting digital accounting software to streamline your financial management. Transitioning to digital software may seem overwhelming at first, so take your time and gradually migrate your financial information to the new platform. Single-entry bookkeeping is often used for tracking cash, taxable income, and tax-deductible expenses. In contrast, double-entry bookkeeping is preferred for managing liabilities, assets, expenses, and revenue.

Streamline Your Finances: Download Our Free Bookkeeping Brochure

- Child care services refer to the professional care, and supervision provided to children in a structured and nurturing environment.

- That’s where an insightful revenue dashboard comes into play, offering a clear, real-time picture of the centre’s financial health.

- It not only strengthens your centre’s financial foundation but also enhances its capacity to grow and adapt in an increasingly competitive market.

- Your chosen software will provide detailed financial statements so you have everything you need come tax time.

- Accounting software can take the efficiency of your child care center to new heights.

The bookkeeping ability to generate detailed reports on revenue, expenses, attendance and any other pertinent financial data is key to making informed decisions. With Procare, you get multiple options for reports to help you make the best decisions for your business. Procare also allows you to automate child care billing to record tuition charges, supply and activity fees, sibling discounts and co-payments and family discounts in seconds.

Effortlessly Manage and Collaborate with Your Team

With a treasure trove of accounting reports, you can see where your business stands within the dashboard, and you’ll have your business taxes basically done before tax time comes around. As a child care provider, you’ll likely be paid upfront for your services. This makes it unlikely that you will run into cash flow issues unless you have a significant amount of expenses. Your goal should always be to generate enough revenue to cover your business expenses, payroll, and taxes. Procare Solutions partners with some of the most popular products and services that you use at your center, including Gusto and QuickBooks. All of this talk about accounting and finances and we haven’t even touched upon your personal budget.

- To do so, you may like to run back over the commonly-faced bottlenecks in billing and accounting processes above, and identify the ones that echo your own.

- Tools that help in tracking various expenses – from petty cash to major expenditures – ensure that every dollar is accounted for.

- Starting a daycare center requires a love of kids, a lot of patience, and even more responsibility.

- It helps you understand your cash flow, prevents overspending, and enables you to identify areas where cost savings are possible.

- All transaction charges, credits, payments and refunds are posted sequentially in the Receivables Ledger.

Exit Planning

Many business owners make the mistake of using their personal bank account for their business, but this can lead to confusion and costly accounting errors. With Procare, you can be confident when you tell families that their financial data, including credit card numbers and information childcare accounting related to ACH transactions, are being protected. When a child has divorced or separated parents who are both responsible for child care payments, the situation can create additional hassles, both among the parents and the child care provider.

Integration with Bookkeeping Software

While single-entry may seem simpler, the double-entry system is renowned for its thoroughness and accuracy. An insightful revenue dashboard is like a compass for a childcare centre, guiding the financial decision-making process. It provides a comprehensive overview of the centre’s financial health , showcasing key metrics such as income, outstanding payments, and ageing buckets.

Here are The Mostly Utilized Small Business CPA And CA Packages

Today’s child care businesses need to operate with precision, timeliness and transparency … and that’s where specialized billing and accounting software comes into play. A childcare billing software can automate these reminders, ensuring they’re sent out consistently, maintaining cash flow without the awkwardness of personal confrontation. This automation also helps in setting a standard for timely payments, crucial for the financial health of your centre. It takes into account all the variables in childcare invoicing – from differing attendance patterns to varied fee structures – and simplifies them into an easy-to-manage process. Setting up healthy accounting habits when you’re starting a childcare business sets you up for success in the future. When you accurately project your finances from the beginning, you’ll also be able to save money for taxes and not face a surprise when it’s time to file.

Before you get ahead of yourself with new accounting software, take a step back and decide what you need to improve as well as which parts of your existing process are already efficient. Understanding what is working and what isn’t will narrow down the options. You will be able to find an accounting solution that addresses problems but also boosts your strong points.

- This method is particularly useful in situations where quicker payment is needed, such as for field trips or special events.

- Effective and accurate expense tracking is at the foundation of your small business bookkeeping.

- The real challenge is finding one that fits your budget, doesn’t limit your growth, and makes accounting less of a burden.

- Procare also allows you to automate child care billing to record tuition charges, supply and activity fees, sibling discounts and co-payments and family discounts in seconds.

- Single-entry bookkeeping is often used for tracking cash, taxable income, and tax-deductible expenses.

Parent Engagement

You’re dealing with diverse fee structures, multiple payment methods, and the need for meticulous record-keeping. You can turn these manual tasks into a streamlined, efficient process with the right approach and the right childcare billing and payment software. Whether you do your own bookkeeping, automate it with software, or pay someone else to do it for you, you should hire a qualified accountant when it’s time to file your childcare business taxes. Business owners no longer have to spend hours manually crunching their numbers in spreadsheets every week. Automatic accounting in your business allows you to see every detail, from total profits to payroll to specific spending budgets. Many childcare directors start as independent providers, sometimes even receiving money under the table.

Child Care

Working with a Business Advisory from ChildCareOwner.com saved my childcare business. If you’re interested in starting your own in-home daycare business, this is the guide for you. For over 30 years, Procare Solutions has helped child care businesses big and small tackle their biggest operational challenges. Integrated payment-processing capabilities allow parents to pay tuition directly through your software, making for a more convenient and swift transaction.