A lower BEP is ideal for businesses with high fixed costs, as it means you can cover your expenses with fewer sales. For example, a SaaS company with high upfront development costs but low variable costs per customer may aim for a lower break-even point by focusing on customer acquisition strategies. For instance, by reducing variable costs or finding ways to lower fixed costs, businesses can decrease the break-even point and achieve profitability with fewer sales.

- When taking this approach, it is important to consider the product break even point (or line item break even point) as well as the overall break even point for the business or sub business units.

- Andy Smith is a Certified Financial Planner (CFP®), licensed realtor and educator with over 35 years of diverse financial management experience.

- Businesses with higher contribution margins can break even with fewer sales, whereas those with lower margins may need significantly higher volumes to cover their fixed costs.

- As we can see from the sensitivity table, the company operates at a loss until it begins to sell products in quantities in excess of 5k.

Sales & Investments Calculators

The break-even point formula divides the total fixed production costs by the price per individual unit less the variable cost per unit. Sensitivity analysis helps businesses explore how costs, pricing, or sales volume changes affect the BEP. For example, if a business increases its prices, the BEP will shift, potentially allowing profitability with fewer units sold. Conversely, if costs rise, the company will need to sell more units to break even.

Break-even analysis examples

Maximizing the contribution margin is a key strategy for reaching the break-even point faster. Higher retention rates can lead to increased revenue, potentially reducing the time to reach the break-even point. These are questions we frequently receive from entrepreneurs who have downloaded the business plan for a mobile app. If anything isn’t clear or detailed enough, please don’t hesitate to reach out. Our business plan for a mobile app will help you succeed in your project.

Free Course: Understanding Financial Statements

This analysis can also serve as a much needed advisor on cutting costs and fixing selling prices. If your break-even point seems unachievable, you can either reduce your fixed or variable costs, or consider raising your prices to lower the number of units you need to sell to break even. As the owner of a small business, you can see that any decision you make about pricing your product, the costs you incur in your business, and sales volume are interrelated. Calculating the breakeven point is just one component of cost-volume-profit analysis, but it’s often an essential first step in establishing a sales price point that ensures a profit.

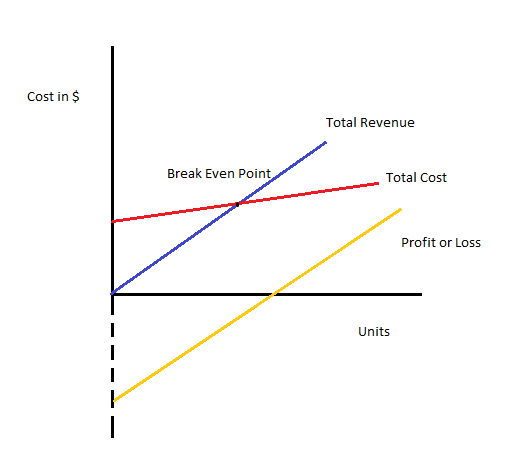

See the time value of money calculator for more information about this topic. An unprofitable business eventually runs out of cash on hand, and its operations can no longer be sustained (e.g., compensating employees, purchasing inventory, paying office rent on time). There is no net loss or gain at the break-even point (BEP), but the company is now operating at a profit from that point onward. Get free guides, articles, tools and calculators to help you navigate the financial side of your business with ease. From this analysis, you can see that if you can reduce the cost variables, you can lower your breakeven point without having to raise your price.

Each tool is carefully developed and rigorously tested, and our content is well-sourced, but despite our best effort it is possible they contain errors. We are not to be held responsible for any resulting damages from proper or improper use of the service. The break-even point is an extremely important starting goal to work towards. No matter whether you are a business owner, accountant, entrepreneur or even a marketing specialist – you will often come across this metric, which is why our online calculator is so handy. Also, remember that this analysis doesn’t take into consideration the present vs. future value of your funds.

He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. We thoroughly evaluate each company and product we review and ensure our stories meet our high editorial standards. Here’s a look at how much solar panel systems cost on average for most states, according to data from FindEnergy.com.

If you consume a lot of electricity, solar might only translate to a small reduction in your electricity costs, which means it could take longer for you to see a return on your investment. That’s why it’s important to think about your home’s energy efficiency before you consider solar panels — you can save money on energy and get a smaller solar panel system. Marketing costs are a significant component of fixed costs and can influence the number of downloads needed to break even. Next, determine your variable costs per download, which might include server costs, payment processing fees, and customer support. Variable Costs per Unit- Variable costs are costs directly tied to the production of a product, like labor hired to make that product, or materials used.

However, if your focus lies on the total sales revenue required, Formula 2 comes into play. This formula determines the total sales revenue required to reach the break-even point. Next, Barbara can translate the number of units into total sales dollars by multiplying the 2,500 units by the total sales price for each unit of $500.

Businesses can prepare for various possible outcomes by running different scenarios and making proactive decisions. Now, determine how much you charge customers for each unit you sell. If you sell your product for $20 per unit, this will be your selling price per unit. It’s also important to keep in mind that all of these models reflect non-cash expense like depreciation. A more advanced break-even analysis calculator would subtract out non-cash expenses from the fixed costs to compute the break-even point cash flow level.

Therefore, PQR Ltd has to sell 1,000 pizzas in a month in order to break even. However, PQR is selling 1,500 pizzas monthly, which is higher than the break-even stimulus checks on the way for turbotax customers after snafu that sent money to wrong bank accounts quantity, which indicates that the company is making a profit at the current level. The selling price is $15 per pizza, and the monthly sales are 1,500 pizzas.