If the loan specifies an annual interest rate of 6%, the loan will cost the company interest of $300 per year or $25 per month. On the December income statement the company must report one month of interest expense of $25. On the December 31 balance sheet the company must report that it owes $25 as of December 31 for interest. Interest payable is the payment obligation that the company owes to its bank or creditor for the borrowing or note payable that it has. As the company does the work, it will reduce the Unearned Revenues account balance and increase its Service Revenues account balance by the amount earned (work performed).

To Ensure One Vote Per Person, Please Include the Following Info

At the end of the month, company needs to record interest payable and interest expense. The journal entry debit interest expense $ 5,000 and the credit interest payable is $ 5,000. For example, on Jan 1, 2020, the company ABC borrows $50,000 money from the bank to expand its business operation. The company ABC is required to pay $3,000 of the interest on Jan 1, every year for 5 years and the principal payment is required to make in the total amount at the end of the borrowing period. The adjusting journal entry in Case 1 is similar to the entries to accrue interest.

What is Qualified Business Income?

We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. This is because such an entry would overstate the acquisition cost of the equipment and subsequent depreciation charges and understate subsequent interest expense. The present value technique can be used to determine that this implied interest rate is 12%. If the item is purchased outright for cash, its price would have been $15,000.

How much are you saving for retirement each month?

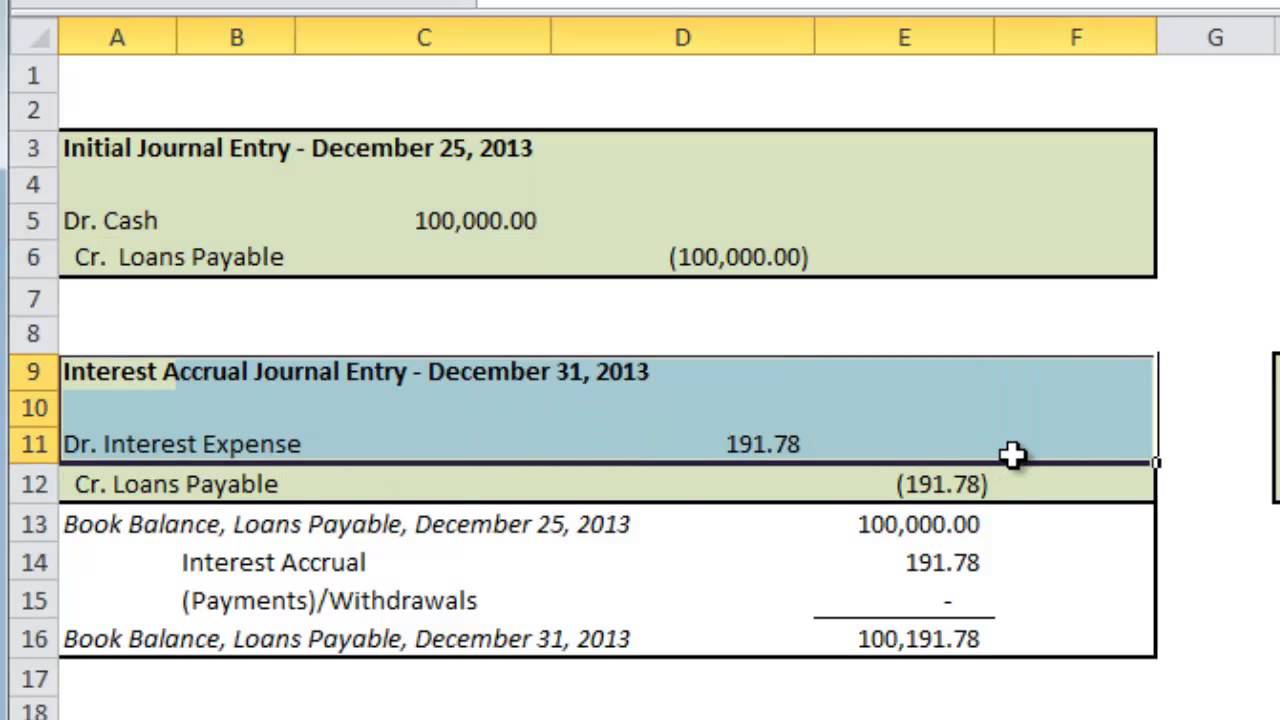

Navigating the ins and outs of interest can get tricky, but Nick makes it easier, explaining the dance between interest receivable and payable. He demonstrates how to record interest that has been earned but not yet received, as well as the steps to take when that interest finally hits the bank account. It’s a clear, real-world scenario that demystifies the financial statements involved and the impact of these entries over time.

Municipal Bonds

- Wages Payable is a liability account that reports the amounts owed to employees as of the balance sheet date.

- However, there is a series of steps that must be followed to ensure the calculation is done accurately.

- A high interest coverage ratio, on the other hand, indicates that there’s enough revenue to cover loans properly.

The bondholders havebonds that say the issuer will pay them $100,000, so that is allthat is owed at maturity. The premium will disappear over time andwill reduce the amount of interest incurred. Bonds issued at face value between interest dates Companies do not always issue bonds on the date they start to bear interest.

So, for semiannual payments, we would divide 5% by 2and pay 2.5% every six months. Under both IFRS and US GAAP, the general definition of along-term liability is similar. However, there are many types oflong-term liabilities, and various types have specific measurementand reporting criteria that may differ between accounting for capital rationing and timing differences the two sets ofaccounting standards. With two exceptions, bonds payable areprimarily the same under the two sets of standards. And since usually we don’t pay for interest expenses right away, the other account part of the journal entry is interest payable, which is a liability account representing the debt.

In the first case, the firm receives a total face value of $5,000 and ultimately repays principal and interest of $5,200. At the end of the note’s term, all of these interest charges have been recognized, and so the balance in this discount account becomes zero. To accomplish this process, the Discount on Notes Payable account is written off over the life of the note. At the origin of the note, the Discount on Notes Payable account represents interest charges related to future accounting periods.

Company ABC borrows $ 100,000 from the bank with an interest rate of 6% per year. The company has to pay the interest expense of $ 500 per month, it is paid on the 5th of each month. On the scheduled date, company has to pay the interest to bank or creditor. The time of paying interest will depend on the loan schedule agreed between borrower and lender. The interest expense record on the income statement is prepared at the end of the month.

Also referred to as a “p.o.” A multi-copy form prepared by the company that is ordering goods. The form will specify the items being ordered, the quantity, price, and terms. One copy is sent to the vendor (supplier) of the goods, and one copy is sent to the accounts payable department to be later compared to the receiving ticket and invoice from the vendor. On the 5th of next month, company has to pay the interest to bank, they have to reverse the interest payable and credit cash. Interest payable is the amount of interest that company owes to the bank or creditors. Interest payable is an accounting term that refers to the amount of interest an entity owes to another party.

Any investors who purchase the bonds at par are required to pay the issuer accrued interest for the time lapsed. The company assumes the risk until its issue, not the investor, so that portion of the risk premium is priced into the instrument. The $200 difference is debited to the account Discount on Notes Payable. This is a contra-liability account and is offset against the Notes Payable account on the balance sheet. Notes payable is a liability that results from purchases of goods and services or loans.

On the date that the bonds were issued, the company receivedcash of $104,460.00 but agreed to pay $100,000.00 in the future for100 bonds with a $1,000 face value. The difference in the amountreceived and the amount owed is called the premium. Since they promised to pay 5% while similarbonds earn 4%, the company received more cash up front.